Watch: Anglo American Rejects BHP Takeover Bid

Latest

The Big Take

Billionaire Stephen Ross Believes in South Florida—and Is Spending Big to Transform It

Interactive

New York and California Each Lost $1 Trillion When Financial Firms Moved South

Bloomberg News Now

Listen to the latest news: Tech Rally, Anglo Rejects BHP Bid, More

6:36

Bloomberg Opinion

US to Announce Up to $6 Billion Arms Commitment to Ukraine

Kim Jong Un Tests New Rockets to Strike Seoul and Perhaps Sell to Putin

Bloomberg News Now

Listen to the latest news: Tech Rally, Anglo Rejects BHP Bid, More

6:36

Latest

Most Active US Stocks

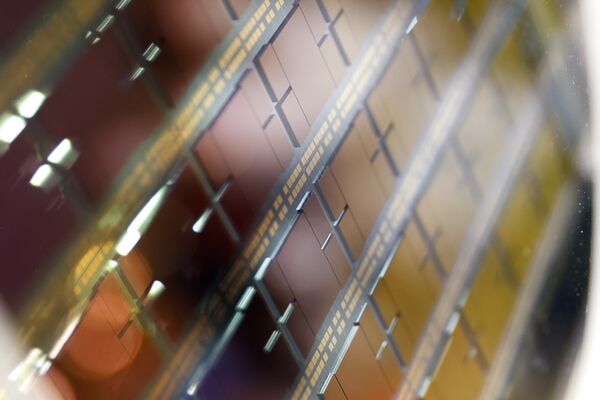

Caught Between the US and China, a Powerful AI Upstart Chooses Sides

Studio Behind Dune Eyes Growth, Even Without a Paramount Merger

Explainers

The Big Take

How to Get a Meeting With the UAE’s $1.5 Trillion Man

Gulf States Learn the Power and Limits of Petrodollar Persuasion